Moving from Toronto to Miami: Complete Relocation Guide

Moving from Toronto to Miami requires careful planning across immigration, financial, and lifestyle dimensions. The transition involves obtaining proper US visa status (H-1B for employment, L-1 for intra-company transfer, or other visa categories), navigating significant tax differences (no state income tax in Florida vs Ontario's provincial taxes), adapting to dramatic climate change (year-round warmth and humidity vs cold winters), and understanding cost-of-living variations where housing may cost 20-40% less but healthcare expenses run higher without provincial coverage. The move typically takes 3-6 months to plan properly, including securing employment sponsorship, finding housing, arranging international moving services, and establishing essential services in Miami.

For Canadians making the permanent move rather than seasonal snowbird stays, Miami offers compelling advantages: no state income tax, vibrant international business community, tropical lifestyle, and growing industries in finance, technology, and hospitality. However, the transition requires navigating US immigration law, restructuring your entire financial life, and adapting to a dramatically different culture and climate.

This comprehensive guide covers everything you need to know about relocating from Toronto to Miami, from visa requirements to neighborhood selection, cost comparisons to cultural adjustments, ensuring your move succeeds both practically and emotionally.

Why Toronto Residents Move to Miami

The Pull Factors:

Climate and Weather:

- Year-round warmth (average 75-85°F)

- No snow, no ice, no winter

- Beach lifestyle 12 months

- Outdoor activities year-round

- Escape Toronto's 4-5 month winter

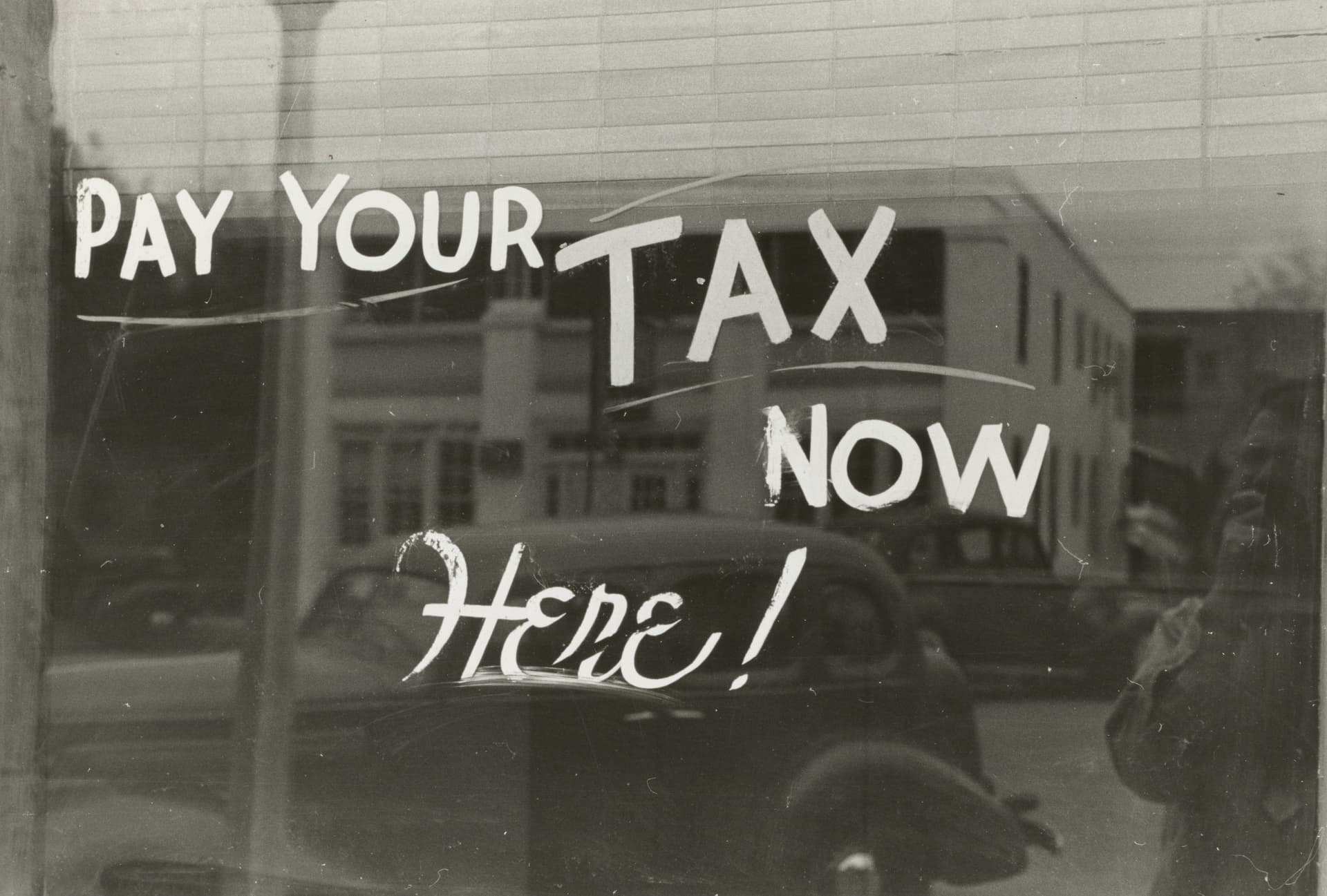

Tax Advantages:

- Florida: No state income tax

- Ontario: Provincial tax up to 13.16%

- Combined savings: 20-40% on taxes for high earners

- No capital gains tax advantage (US federal applies)

- Estate tax considerations

Business and Career:

- Miami: Growing financial hub

- Latin America gateway

- International business center

- Tech sector expanding

- Finance and hedge funds relocating

- Lower corporate taxes

Cost of Living:

- Housing often less expensive

- Property taxes comparable

- No provincial sales tax (but 7% state sales tax)

- Overall 10-20% lower for similar lifestyle

Lifestyle:

- Vibrant international culture

- Latin American influence

- Restaurant and nightlife scene

- Beach and water sports

- Year-round outdoor lifestyle

- No language barrier (mostly English)

The Push Factors:

Leaving Toronto:

- High cost of living (especially housing)

- Cold, long winters

- High tax burden

- Traffic congestion

- Desire for change

Common Profile: Typical Toronto-to-Miami movers:

- Age 30-50

- Professionals in finance, tech, business

- High income (benefit most from tax savings)

- Entrepreneurial

- Love warm weather

- International mindset

Immigration and Visa Requirements

You Cannot Just Move:

Critical Point: Canadians cannot simply relocate to Miami and live permanently. You need proper immigration status.

Tourist Status Not Sufficient:

- B-2 tourist status: 6 months maximum

- Cannot work

- Cannot establish permanent residence

Work Visa Options:

H-1B Specialty Occupation:

- Employer-sponsored

- Requires bachelor's degree minimum

- Specific occupation (tech, finance, engineering, etc.)

- 3-year initial period (renewable to 6 years)

- Path to green card

- Annual cap (lottery system)

Process:

- Find employer willing to sponsor

- Employer files petition

- If selected in lottery, approved

- Apply for H-1B visa

- Enter US and start work

Timeline: 6-12 months minimum

L-1 Intracompany Transfer:

- Must work for multinational company

- Transfer from Canadian office to US office

- L-1A (managers/executives): Up to 7 years

- L-1B (specialized knowledge): Up to 5 years

- No annual cap

- Easier than H-1B

Requirements:

- Worked for company abroad at least 1 year

- Transferring to related US entity

- Managerial, executive, or specialized role

TN Visa (USMCA/NAFTA):

- Canadian/Mexican professional visa

- Specific professions listed in treaty

- Easy to obtain

- 3-year periods (renewable indefinitely)

- No annual cap

Common TN Professions:

- Accountant

- Engineer

- Computer systems analyst

- Management consultant

- Economist

- Lawyer (with LL.B.)

- Many others (see official list)

Process:

- Job offer from US employer

- Apply at border or port of entry

- Same-day approval possible

- Easier than H-1B

Limitations:

- Not explicitly dual intent (harder path to green card)

- Must maintain Canadian residence

- Renewable but not permanent

E-2 Investor Visa:

- Invest substantial capital in US business

- Minimum ~$100,000+ investment

- Must be active business owner

- Renewable indefinitely (2-year increments)

Requirements:

- Significant investment

- Creating jobs for Americans

- Active management of business

Green Card (Permanent Residence):

Fastest Paths:

- Employment-based (EB-1, EB-2, EB-3)

- Family-based (if married to US citizen/permanent resident)

- Investor (EB-5: $800,000-$1,050,000 investment)

Timeline: 2-10 years depending on category

Canadian Advantage:

- No country-quota delays

- Faster than many nationalities

- Strong educational backgrounds

Professional Help Required:

Immigration Attorney: Essential for:

- Determining best visa category

- Preparing applications

- Employer sponsorship coordination

- Green card applications

Cost: $3,000-$15,000+ depending on complexity

Don't attempt DIY - errors cause delays or denials.

Cost of Living Comparison

Housing Costs:

Toronto (2024-2025):

- 1-bedroom condo downtown: $2,500-$3,500/month rent

- 2-bedroom condo downtown: $3,500-$5,000/month rent

- Purchase (1-bedroom): $600,000-$900,000

- Purchase (2-bedroom): $800,000-$1,200,000

Miami (2024-2025):

- 1-bedroom condo (Brickell): $2,800-$4,000/month rent

- 2-bedroom condo (Brickell): $4,000-$6,000/month rent

- Purchase (1-bedroom): $350,000-$650,000

- Purchase (2-bedroom): $500,000-$1,000,000

Comparison:

- Rent: Comparable or slightly higher in Miami (luxury areas)

- Purchase: 30-40% less in Miami for similar quality

- More space for money in Miami

- Property taxes similar (~2% vs Toronto ~1%)

Income Taxes:

Toronto/Ontario:

- Federal: 15-33%

- Provincial: 5.05-13.16%

- Combined: 20-46% on high income

- CPP/EI contributions

- Example: $150,000 income = ~$45,000 tax

Miami/Florida:

- Federal: 15-37%

- State: 0%

- FICA (Social Security/Medicare): 7.65%

- Example: $150,000 income = ~$30,000 tax

- Savings: $15,000/year

Sales Tax:

- Ontario: 13% HST

- Florida: 6-7% sales tax

- Groceries exempt in Florida

- Clothing taxed in Florida (not in Ontario)

Utilities:

- Electricity: Similar ($100-200/month)

- AC costs: Higher in Miami (year-round)

- Heating: $0 in Miami vs $100-300/month Toronto winter

- Water: Comparable

- Internet: Comparable ($60-100/month)

Transportation:

Toronto:

- TTC metro pass: $156/month

- Car insurance: $1,500-$3,000/year

- Gas: $1.60-1.80/liter

- Parking: $200-400/month downtown

Miami:

- No comparable public transit (car required)

- Car insurance: $1,800-$3,500/year

- Gas: $0.85-1.00/liter (much cheaper)

- Parking: Often included with condo

- Must own car in Miami

Food and Dining:

- Groceries: Comparable

- Restaurants: Similar prices

- Dining out: Slightly less expensive in Miami

- Alcohol: Less expensive (lower taxes)

Healthcare:

Toronto:

- OHIP: Free provincial coverage

- No premiums

- Prescriptions: Pay or private insurance

Miami:

- Must have private insurance: $400-800/month

- Employer often provides

- Deductibles: $1,000-$5,000

- Out-of-pocket maximum: $5,000-$10,000

- Major expense difference

Overall: For $150,000 income professional:

- Toronto: Higher taxes, free healthcare, public transit option

- Miami: Lower taxes, expensive healthcare, car required

- Net advantage: Miami saves 10-20% overall with tax savings

Finding Housing and Neighborhoods

Where Toronto Transplants Settle:

Brickell (Miami's Financial District):

- Most similar to Toronto's Financial District

- High-rise condos

- Young professionals

- Walkable to offices

- Vibrant dining/nightlife

- Rent: $3,000-$6,000 (2BR)

- Purchase: $500,000-$1,500,000

Edgewater:

- Waterfront location

- Newer construction

- Slightly quieter than Brickell

- Easy access to downtown

- Parks and bay views

- Similar pricing to Brickell

Coconut Grove:

- More established, leafy

- Similar to Toronto neighborhoods like Leslieville

- Village feel

- Families and professionals

- Restaurants and boutiques

- Rent: $3,500-$7,000 (2BR)

Coral Gables:

- Mediterranean architecture

- Tree-lined streets

- Excellent schools

- Upscale residential

- Similar to Toronto's Forest Hill

- Higher prices, family-oriented

Aventura:

- North Miami Beach area

- Large condo buildings

- Shopping (Aventura Mall)

- Good for families

- More affordable

- Further from downtown

For detailed neighborhood comparisons, see Miami neighborhoods guide.

Renting vs Buying:

Rent First (Recommended):

- Get to know areas

- No long-term commitment

- Understand commute

- Test neighborhoods

- 6-12 months minimum

Then Buy:

- Once settled

- Know preferred area

- Understand market

- Established credit/employment

Finding a Place:

Rental Search:

- Zillow, Apartments.com

- Local real estate agents

- Facebook groups (Miami expat groups)

- Corporate housing (temporary)

What You Need:

- Employment verification

- Credit report (US credit if available)

- Bank statements

- First month + last month + security deposit

- Higher deposit if no US credit history

Buying Process: For Canadians purchasing Miami property, see Canadian buying guide.

Employment and Job Market

Miami's Growing Industries:

Finance:

- Hedge funds relocating from NYC

- Private equity

- Asset management

- Banking

- Fintech

Technology:

- Growing tech scene

- Startups

- Remote workers

- Tech hubs emerging

International Business:

- Latin America gateway

- Import/export

- Trade finance

- Consulting

Real Estate:

- Development

- Brokerage

- Property management

- Investment

Healthcare:

- Major hospital systems

- Medical tourism

- Biotech

Hospitality:

- Hotels and resorts

- Restaurants

- Tourism industry

Job Search Strategies:

Before Moving:

- Network on LinkedIn

- Research companies

- Attend virtual Miami networking events

- Connect with Toronto-to-Miami transplants

- Identify employers who sponsor visas

Visa Sponsorship: Essential questions:

- Does company sponsor H-1B?

- Do they have L-1 transfers?

- TN visa acceptable?

- Timeline for sponsorship

Many companies won't sponsor - target those that do.

Salary Expectations:

Comparable Roles:

- Finance: Often similar to Toronto (or higher)

- Tech: Slightly lower than Silicon Valley, comparable to Toronto

- General business: Comparable

- Adjusted for no state tax: 10-15% effective increase

Negotiating:

- Factor in healthcare costs

- Car expenses (required)

- No transit option

- Cost of living overall

Starting a Business:

E-2 Visa Path: If entrepreneurial:

- Invest in US business

- E-2 visa eligibility

- Full control

- Renewable indefinitely

Lower Costs:

- No corporate income tax (state level)

- Business-friendly environment

- Access to Latin American markets

Logistics of the Move

Moving Your Belongings:

International Moving Companies:

- Get 3+ quotes

- Door-to-door service

- Customs clearance included

- Insurance coverage

Cost Estimates:

- 1-bedroom: $3,000-$5,000

- 2-bedroom: $5,000-$8,000

- 3-bedroom house: $8,000-$15,000

Timeline: 2-4 weeks transit

What to Bring:

- Furniture (if worth it)

- Personal items

- Important documents

- Electronics (110V compatible)

What to Leave:

- Large furniture (sell or store)

- Winter clothes (donate most)

- Items easily replaceable

Customs Considerations:

Personal Effects:

- Free of duty (if owned 1+ year)

- Detailed inventory required

- Proof of prior ownership

Vehicles:

- Can import Canadian car

- Must meet US safety/emissions standards

- Usually easier to sell in Canada and buy in US

- Left-hand drive already (advantage over some countries)

Documents to Bring:

Critical:

- Passport

- Visa documentation

- Birth certificate

- Marriage certificate (if applicable)

- Educational credentials (diplomas, transcripts)

- Employment records

- Medical records

- Financial statements

- Tax returns (last 3 years)

- Driver's license

Financial Transition:

Bank Accounts:

- Open US bank account (Chase, Bank of America, Wells Fargo)

- Keep Canadian account open initially

- Transfer funds as needed

- Use forex specialist (better rates than banks)

Credit History:

- Start building US credit immediately

- Apply for secured credit card

- Get credit through bank

- No Canadian credit history transfers

Driver's License:

- Florida requires new license

- Surrender Canadian license or keep for ID

- Written and driving test may be required

- Do within 30 days of establishing residency

Healthcare:

- Research employer health insurance

- Understand coverage

- Find doctors (primary care, dentist)

- Transfer prescriptions

Mail and Address:

- US address required

- Mail forwarding from Canada (temporary)

- Update all accounts and subscriptions

- Notify CRA (Canada Revenue Agency)

Tax and Financial Considerations

Becoming US Tax Resident:

Substantial Presence Test: Living in Miami permanently means:

- US tax resident status

- File US tax return (1040)

- Report worldwide income

- Subject to US tax rates

Canadian Tax Status:

Becoming Non-Resident: If severing Canadian ties:

- Notify CRA

- File departure tax return

- Deemed disposition of assets

- No longer pay Canadian tax

Maintaining Ties: If keeping Canadian property, bank accounts:

- May still be Canadian tax resident

- File in both countries

- Foreign tax credits prevent double taxation

Complex - hire cross-border accountant.

RRSP and TFSA:

RRSPs:

- Can keep as US resident

- Defer withdrawals

- Taxed when withdrawn

- US-Canada tax treaty protects

TFSAs:

- Not recognized by US

- US taxes growth

- Consider collapsing before moving

CPP/OAS:

- Continue to qualify (based on contributions)

- Receive in retirement even if US resident

- Taxable in US

Estate Planning:

US Estate Tax:

- $13.61 million exemption (2024) for US citizens

- Only $60,000 for non-citizens/non-residents

- Canada-US treaty provides relief

- Complex planning needed

Professional Help:

Cross-Border Specialists: Essential:

- Immigration attorney (visa)

- Cross-border accountant (tax)

- Financial advisor (investments)

- Estate planner (if significant assets)

Cultural and Lifestyle Adjustments

Climate Adaptation:

Year-Round Summer:

- No seasons (perpetual summer)

- AC everywhere (indoors cold)

- Humidity adjustment (80-90%)

- Hurricane season (June-November)

- Some miss fall colors, snow

Different from snowbirding:

- Can't escape to Canada for summer

- Must adapt to heat

- Summer less active (too hot)

Cultural Differences:

More Casual:

- Less formal than Toronto

- Beach culture influence

- Slower pace

- Less punctual (Miami time)

International:

- Large Latin American population

- Spanish widely spoken (helpful to learn)

- Diverse food scene

- Multiple cultures blending

Car Dependency:

- Must drive everywhere

- Traffic can be bad

- No TTC equivalent

- Different commute patterns

Social Integration:

Finding Community:

- Canadian expat groups

- Professional networking

- Neighborhood associations

- Sports and activities

- Religious communities

Online Groups:

- Facebook: Toronto to Miami Expats

- Canadian Snowbirds groups

- Miami professional networks

Making Friends:

- Join activities/clubs

- Co-working spaces

- Networking events

- Volunteering

What You'll Miss:

From Toronto:

- Four seasons

- Fall colors

- Tim Hortons (sort of - some in Florida)

- Universal healthcare

- Public transit

- Winter activities

- Family and friends

- Canadian politeness

What You'll Gain:

In Miami:

- Beach lifestyle

- Year-round outdoor activities

- No winter

- International business opportunities

- Tax savings

- Diverse culture

- Water sports

- Vibrant nightlife

Making Your Move Successful

Timeline for Relocation:

6-12 Months Before:

- Research visa options

- Consult immigration attorney

- Begin job search

- Save moving funds

- Research neighborhoods

3-6 Months Before:

- Secure job/visa sponsorship

- Hire immigration attorney

- File visa petition

- Research housing

- Get moving quotes

1-3 Months Before:

- Visa approved

- Book flights

- Arrange temporary housing

- Hire movers

- Close/transfer accounts

- Medical exams (if required)

Moving Month:

- Pack and ship belongings

- Close/rent out Canadian property

- Say goodbyes

- Travel to Miami

- Start new job

First Month in Miami:

- Find permanent housing

- Open bank accounts

- Get driver's license

- Establish utilities

- Set up healthcare

- Explore neighborhoods

Practical First Steps:

Week 1:

- Check into temporary housing

- Start new job

- Open bank account

- Get US phone number

Week 2-4:

- Apartment hunting

- Apply for driver's license

- Set up utilities

- Find grocery stores, necessities

- Explore neighborhoods

Month 2-3:

- Move into permanent housing

- Establish routines

- Make social connections

- Join gym/activities

- Get involved in community

Resources for New Residents:

Essential Services:

- DMV: Florida driver's license

- Social Security office: Social Security Number

- USCIS: Immigration status changes

Professional Networks:

- Miami Chamber of Commerce

- Industry-specific groups

- LinkedIn local groups

Expat Communities:

- Canadian American Business Council

- Toronto expat groups

- International resident organizations

Is Miami Right for You?

Consider Miami If:

- You love warm weather year-round

- Tax savings are significant for you

- Career opportunities in Miami industries

- Entrepreneurial spirit

- Beach/water lifestyle appeals

- International culture interests you

- No state income tax matters

Reconsider If:

- You love four seasons

- Healthcare costs concern you

- Car dependency is dealbreaker

- You need robust public transit

- Family ties to Toronto very strong

- Established Toronto career hard to replicate

Trial Period:

Before Full Relocation:

- Extended stay (3-6 months if visa allows)

- Test climate year-round

- Experience summer heat

- Explore neighborhoods extensively

- Network in industry

- Ensure it feels right

The Toronto-Miami Connection:

Growing community of Toronto transplants means:

- Networking opportunities

- Shared experiences

- Community support

- Business connections

Many successfully make the transition and never look back.

Pink Miami works extensively with Canadian relocations and can help you find the perfect Miami property for your new chapter. Our team understands the unique needs of Toronto transplants and can guide you through housing, neighborhoods, and settling into Miami life.